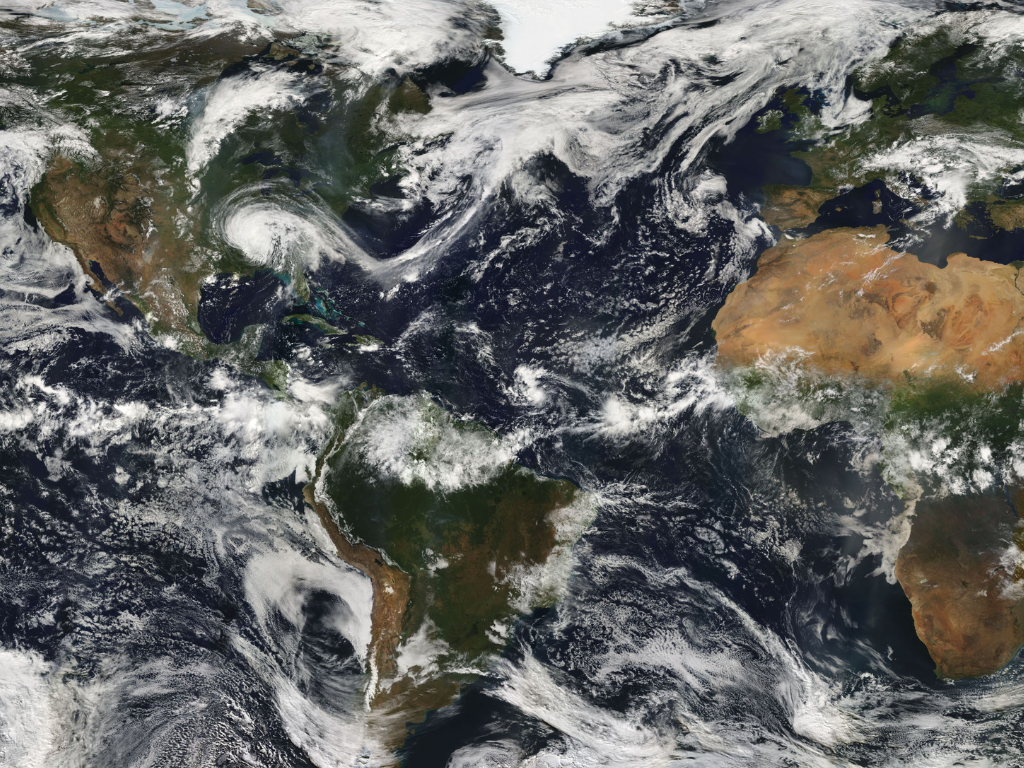

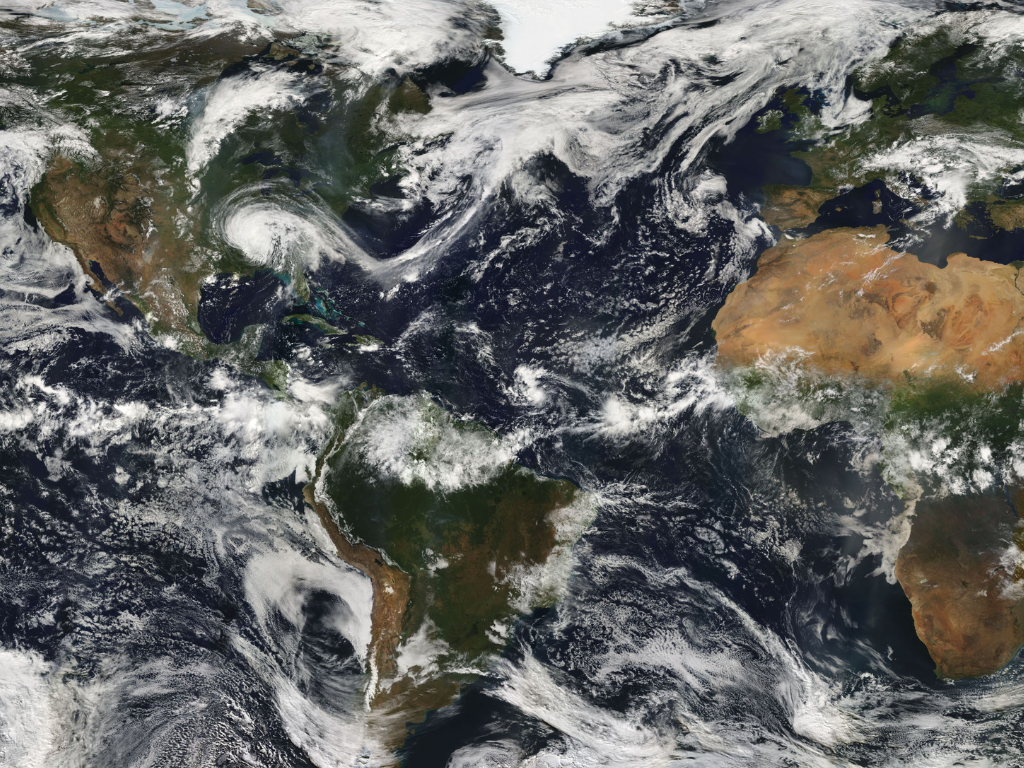

Climate Change Part 2, From Risk to Resilience

Climate change is already influencing how business insurance is priced and underwritten.

You never think it will be your business. Then one night, the call comes, a fire, a flood, a break-in. Within minutes, everything you’ve built is under threat.

Most people believe their insurer will handle everything. They won’t.

In reality, when a major loss hits, it’s not just your property or stock at risk, it’s your time, your mental health, and your ability to keep trading.

After the shock fades, you’re left with urgent questions:

The reality is that insurance only pays for damage. It doesn’t manage the paperwork, the delays, or the stress. You’re left to pick up the pieces, prove every loss, and battle red tape, just when your focus should be on getting back to business.

In those first few hours and days, every decision counts:

It’s overwhelming. Most business owners are experts in their field, not in insurance claims.

💡 Did You Know?

“Over 80% of SMEs who suffer a major loss are not in business twelve months later. You need to plan ahead in case the worst happens.”

Take a Japanese restaurant in London’s West End. A kitchen fire forced them to close overnight, bookings cancelled, income lost, reputation on the line. But they had Loss Recovery Insurance.

That meant a chartered loss adjuster arrived quickly, managed every part of the claim, fast-tracked repairs, and got them open again sooner, with less financial damage.

Or the office landlord in Westminster, whose basement flooded after a storm.

Tenants displaced, rent on hold. But LRI meant immediate expert help, emergency works arranged, and the claim negotiated without delay.

The owner didn’t have to do it all themselves, and their income was protected.

With LRI as an added extra to your commercial policy, you don’t have to be the expert. A chartered loss adjuster steps in to:

You focus on running your business. The stress, admin, and negotiation are taken care of.

You can’t predict when disaster will strike, but you can choose to have the right support in place.

If you want to safeguard your business, and get back on your feet faster after a loss, Loss Recovery Insurance could be the most important cover you ever add.

Call FSB Insurance Service on 020 3883 7976 to find out how LRI works, and what it can do for you.

Let the experts carry the load, so you can focus on what matters most.

📞 Ready to Talk?

Want to add LRI to your cover? Call FSB Insurance Service on 020 3883 7976 to find out how. We’ll help you protect what you’ve built, and bounce back when it counts.

This content is for general information only and is not intended to provide advice or a personal recommendation. Insurance cover is subject to the terms, conditions, and exclusions of the policy. Always consider your individual circumstances and seek professional advice before arranging insurance. External websites are not under our control and we are not responsible for their content.

Climate change is already influencing how business insurance is priced and underwritten.

Public sector work requires liability cover and continuity planning.

A practical guide for UK SMEs on the crucial steps to take after a fire.